For the seasoned professional contemplating an MBA degree, the question is as old as the degree itself: Is the investment worth it? The return on investment (ROI) of an MBA is often reduced to a simple, transactional equation: tuition cost vs a fatter pay cheque. But as South Africa’s leading business schools are quick to argue, this narrow view misses the point. The true value of an MBA, they say, is not found in a spreadsheet but in the transformation of a leader’s character and capacity to create lasting value.

Milpark Business School CEO Andrew Horsfall puts it bluntly: “The challenge in trying to turn an MBA decision into a transaction is that it betrays a misunderstanding of what you’re trying to do with an MBA in the first place.”

The fundamental purpose of the degree is to transform the way you think and see yourself. For Horsfall, focusing on a better job or a salary increase misses the deeper narrative. “You can skate along the surface and pass an MBA by virtue of just playing the game, but at the end of it, all you have is a certificate. It doesn’t mean you have been transformed.”

This sentiment is echoed across the board. Boston City Campus dean Cobus Oosthuizen insists the MBA cannot be reduced to a “narrow balance sheet equation”. He advises students to view financial ROI as just one layer, albeit an important one, incomplete if taken alone. The real question, he says, is not “How much more will I earn?” but rather, “What trajectory will this education enable me to shape?”

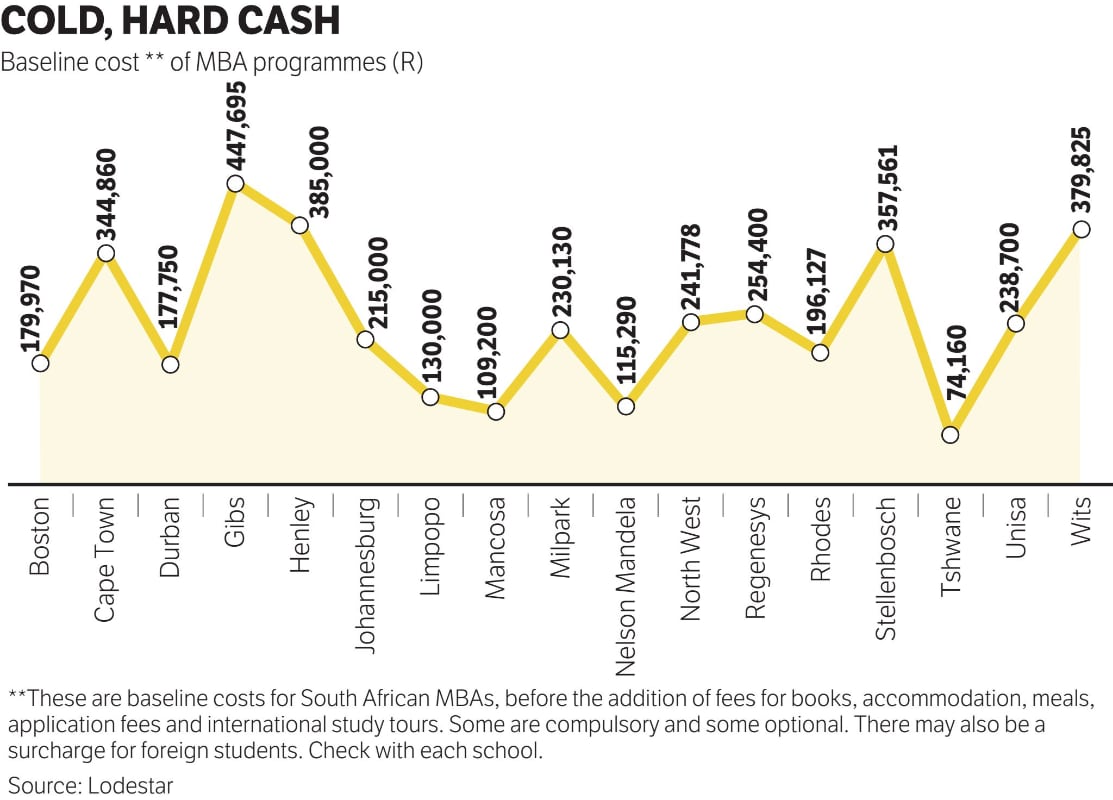

While the focus has shifted to intangible benefits, the financial calculus remains a critical starting point. The financial investment for an MBA varies. For instance, the University of Cape Town Graduate School of Business (GSB) charges R345,860, while Stellenbosch Business School (SBS) lists its 2025 tuition fee at R478,411. At the Gordon Institute of Business Science (Gibs), the total cost of an MBA is R551,195, and at Rhodes Business School, R196,527.

These figures may include compulsory add-ons such as international study tours. At Gibs, if you opt for an African study tour rather than the worldwide one, the bill comes to R504,195.

At the bottom end of the price ladder, the Tshwane School for Business and Society, at the Tshwane University of Technology, costs just R74,160. On the next rung up is the Management College of Southern Africa (Mancosa) at R109,200. Nelson Mandela University (NMU) Business School comes in at R115,290 and the University of Limpopo’s Turfloop Graduate School of Leadership at R130,000.

NMU’s MBA comes with international accreditation from the UK-based Association of MBAs, underlining the argument of all low-cost business schools that cheapness does not necessarily equal poor quality.

If you or, more likely, your employer, have money to spare, an overseas MBA might work. For top-ranked global programmes, tuition alone can range from $70,000 to more than $160,000 for the full programme. The total estimated cost of a two-year US MBA, factoring in tuition, living expenses and other fees, can exceed $245,000.

An MBA is a long-term investment that grows with the graduate, enabling lifelong learning

— Jenika Gobind

The potential for earning a higher salary after an overseas MBA can lead to a rapid payback period in certain global markets. However, for many South African professionals, the local MBA model is more viable and contextually relevant.

Lebogang Mosupye-Semenya, senior lecturer at Johannesburg Business School, suggests that a professional earning R1m annually before the MBA can expect a salary uplift of between 30% and 80% after graduation.

At the lower end, this results in a post-MBA salary of R1.3m, a net gain of R85,000 after tuition, reflecting an ROI on tuition fees of about 40%. At the higher end, with an 80% increase, the post-MBA salary rises to R1.8m, delivering a net gain of R585,000 after tuition, equivalent to an ROI of about 272%.

Jenika Gobind, MBA programme director at Wits Business School (WBS), says graduates can expect a 50%-80% increase post-graduation. “Benefits clearly outweigh the costs,” she says. “An MBA is a long-term investment that grows with the graduate, enabling lifelong learning. Unlike other qualifications, the MBA offers a range of options and career paths.”

SBS brand manager Hajirah Cassiem says prospective students should look at both the short- and long-term financial considerations of an MBA. “Research consistently shows that MBA graduates experience significant salary increases three to five years after completion, alongside broader career mobility.”

Rhodes Business School director Owen Skae says the school’s alumni survey shows clear evidence of career progression and salary growth. For example, post-qualification, all respondents were economically active (either employed or self-employed), with increases in top management (from 6.6% to 9.9%), business ownership (from 6.6% to 11%), and middle management (from 26.4% to 45.1%). “Many alumni also reported promotions, international career moves and, in some cases, salaries tripling.”

GSB director Catherine Duggan says: “It is certainly the case that companies and the MBA students they sponsor benefit directly from the leadership skills, business acumen and adaptability that students gain on an MBA programme.” She says those benefits are not only typically immediately identifiable, but they also create long-term value for both the company and the MBA graduate.

One of the biggest advantages of her school’s modular MBA, says Duggan, is that students don’t have to step away from their careers to study. Instead, they can “learn something in one of our lecture theatres on Friday and put it into practise at work the following Monday”, which creates immediate value not only for the students but also for their employers.

She stresses that the type of MBA chosen has an impact on the long-term returns. While online programmes can deliver “an immediate boost in business acumen in a way that minimises the time investment”, she argues that they are likely to be less useful in the long run compared with programmes that emphasise leadership, critical thinking and global exposure.

The deeper ROI, says Jon Foster-Pedley, dean and director of Henley Business School Africa, lies in “capability transformation”. An MBA, he adds, “deliberately develops higher-order cognitive skills, the ability to diagnose root causes rather than treat symptoms, to think clearly in the midst of ambiguity, and to mobilise people to achieve more than they believed possible”. This translates into accelerated promotions and greater career resilience.

The nonfinancial benefits of an MBA are a recurring theme. One of the most consistently cited benefits is the opportunity to forge a powerful network. This extends beyond connecting with a diverse group of peers to include access to industry leaders and an influential alumni community, which can open doors and provide mentorship long after the programme ends.

Regenesys dean Sibongiseni Kumalo and business school head Patience Nyoni say their MBA programme provides extensive opportunities for professional networking, connecting students with their peers, faculty and a global alumni network. “This network is invaluable for exploring new career paths and business ventures,” they say.

Students build lasting networks with peers across geographies, and these networks often evolve into partnerships, mentorships and collaborative opportunities, says Joseph Sekhampu, director of North-West University Business School. “In this way, the MBA supports a wider leadership pipeline, particularly in regions beyond South Africa’s major urban centres.”

This professional expansion is paralleled by personal growth and leadership confidence. The MBA programme is designed to foster critical thinking, resilience and a broader perspective on business and society.

Mosupye-Semenya says the programme challenged her to think “beyond theory, beyond today, and to build solutions that solve real-world challenges”.

Furthermore, in an increasingly complex and interconnected world, the focus on ethical and responsible leadership has become a crucial nonfinancial return. The values of a business school and its emphasis on ethical practice are central to the MBA experience.

For Mancosa, this commitment is rooted in its founding principles. School manager Aradhana Ramnund-Mansingh says the institution was established after its founder was rejected from a business school because of his race. “He said no-one should face that humiliation, from an inclusion perspective and from an affordability perspective.”

Ramnund-Mansingh says prospective students are asked: “How are you going to give back? How are you going to develop South Africa?”

The versatility of an MBA offers an advantage more than other postgraduate qualifications. While these may deepen expertise in a single area, the MBA is holistic and integrative, pulling together finance, strategy and leadership to equip professionals to navigate economic uncertainty and technological change.

Henley Africa MBA director Lyneth Zungu says the lessons from an MBA extend beyond the classroom, enabling students to use what they have learnt to build Africa. “We need entrepreneurial, management and leadership skills to help solve Africa’s many challenges,” she says. “We need people who are fired up and think outside of the box, and this is what a good MBA teaches you to do.”

WBS management specialist Prof Jones Odei-Mensah adds: “In uncertain times, adaptability and leadership are at a premium.” An MBA equips professionals with a broad-based management toolkit — finance, strategy, innovation and leadership — combined with a network that spans industries and geographies.

The enduring value of the degree is not in the certificate itself but in its power to act as a catalyst for career transition and personal growth, he says. It enables professionals to navigate, lead and innovate within their chosen industries.

South Africa’s socioeconomic complexity demands leaders who can navigate volatility with ethical conviction, contextual intelligence and strategic foresight, says Sekhampu.

According to Odei-Mensah, the MBA is not just an investment in a bigger pay cheque, but a durable platform for lifelong learning, career sustainability, and leadership on the continent and beyond. That is the real return on investment.

Would you like to comment on this article?

Sign up (it's quick and free) or sign in now.

Please read our Comment Policy before commenting.